This comes with the standard options for your checkout page, including PayPal, credit/debit cards, pay later options, Venmo, and others.

#PAYPAL TRANSACTION FEES PLUS#

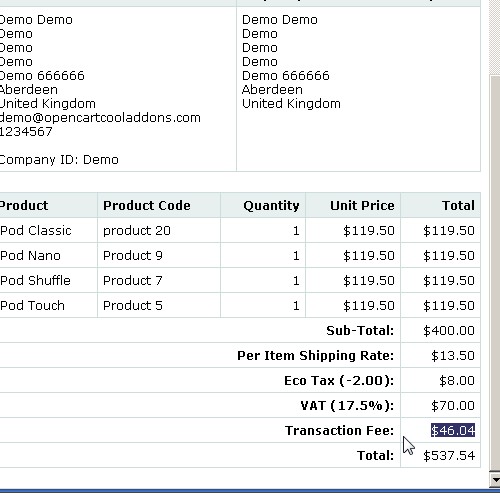

When you sign up for PayPal, your default rate will be the standard rate of 2.99 percent, plus a fixed $0.49 per transaction. Most of PayPal’s main fees and operating costs come from its extensive per-transaction fees. PayPal’s advanced payments program will also handle security or PCI compliance for you. The platform doesn’t charge merchants additional account maintenance fees, customer service fees, or termination/account closure fees for their standard plan. The fixed fee per transaction depends on a country’s currency.

The percentage of the transaction amount ranges from 1.90 percent to 3.49 percent, plus a fixed fee per transaction ranging from $0.05 to $0.49.

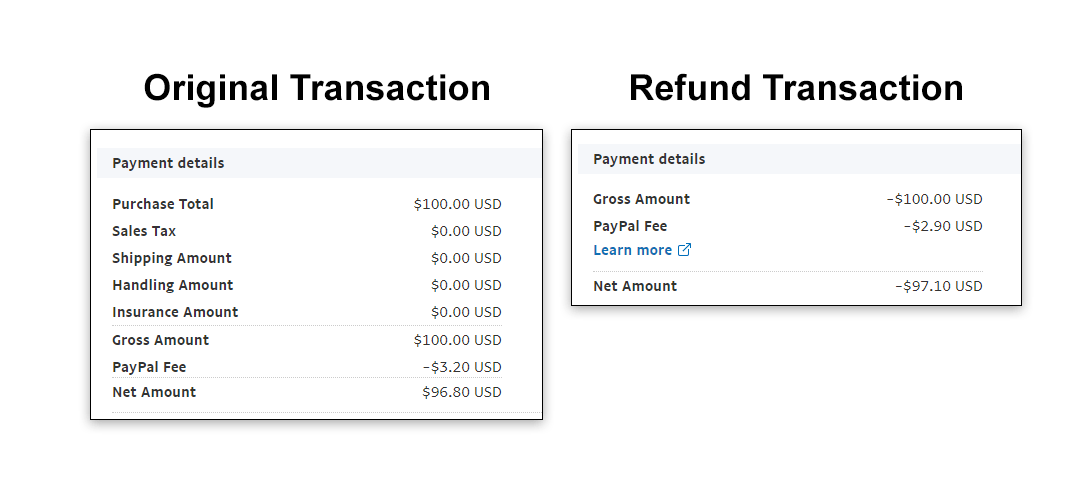

These fees are taken as a percentage of the transaction amount, plus a fixed fee. The main fees PayPal charges merchants are commercial transaction fees. For merchants, PayPal charges a variety of fees based on the service plan, payment type, currency received, and domestic vs. Transactions made online and in-person, without needing to convert the currency, are free. What Kinds of Fees Should You Expect on PayPal? As a merchant, you will see fees deducted from your deposits for every transaction you run.

#PAYPAL TRANSACTION FEES FOR FREE#

As a regular PayPal user, you will use their services for free unless you send payments with a credit card. PayPal is transparent about its flat-rate credit card processing fees, but its fee structure is quite complex. Let’s get started! Does PayPal charge a fee? This in-depth article, details PayPal’s fees and what you can do to avoid them. The exact amount that PayPal charges depends on a variety of factors and it often becomes hard for businesses to see where they should see these costs. As a payment service provider, PayPal’s convenient payment services come at a big cost to business owners. PayPal’s for-profit business model generates income by charging fees for online payments and payment services between consumers and merchants.

0 kommentar(er)

0 kommentar(er)